The evolution of the HMO market and current hotspots

HMOs (House of Multiple Occupation) first came to prominence in the form of student digs: fairly tatty shared houses, where students could live in groups for a low monthly rent. Until the law really started to focus on the condition and safety of privately rented properties, there were undoubtedly too many landlords profiting by taking advantage of those who couldn’t afford anything better and didn’t want to complain in case they were evicted.

‘Professional’ HMOs really took off in the mid-2000s, when buy-to-let investors realised that if they made the effort to provide an attractive, well-maintained shared home, working adults were prepared to pay a relatively high all-inclusive rent for a private room. And although running costs were higher than if the property was let to a single household, the rent could be two to three times more.

This high profit margin, at a time when mortgage interest rates were falling to record lows, meant investors could easily qualify for, and afford to make the payments on high loan-to-value mortgages. And with lower percentage deposits required, they could spread their capital across more HMO investments, further increasing their rental profits.

But around this time was when legislation started to tighten up for the whole Private Rental Sector (PRS), with HMO landlords subject to additional regulation:

- 2005: HMO landlords were required to carry out risk assessments and install fire safety measures to mitigate those risks, including fire doors, alarms, extinguishers & blankets.

- 2006: Licensing was brought in for HMOs housing five or more individuals, but it only applied if the property was three storeys or more – so many investors simply stuck to two-storey houses.

Then there wasn’t anything that hit the HMO sector particularly hard for around a decade, and it continued to grow. Many landlords moved into the ‘luxury HMO’ market, providing accommodation with a boutique hotel feel that appealed to tenants with professional jobs, who either couldn’t afford to rent a whole property or simply didn’t want to.

- 2018: The ‘three or more storeys’ criteria was removed from the licensing requirement. Suddenly, not only did many more HMO landlords have to pay for a licence, but their local authority could demand that changes were made to the property as a condition of the licence.

- 2018: Minimum room sizes were introduced for HMOs, at which point some landlords found that rooms they had been letting as single bedrooms could no longer be legally let, which instantly cut a significant amount from their profits.

- 2023: Most recently, in January of this year, new fire safety regulations came into force into force, requiring a ‘responsible person’ to be appointed for every HMO, to ensure certain fire safety instructions and information is provided to all occupants.

Of course, all these legal changes have been good news for tenants in terms of improving standards and health and safety in shared houses. However, they have undoubtedly made setting up and managing HMOs more challenging.

How profitable are HMOs today?

Because rents have been increasing at a higher than usual rate over the past few years and energy costs are still high, tenants are snapping up all-inclusive room rentals. And while you must meet the legal standards for condition and health and safety, as long as your HMO is modern and well-maintained, it doesn’t have to be fancy to be profitable.

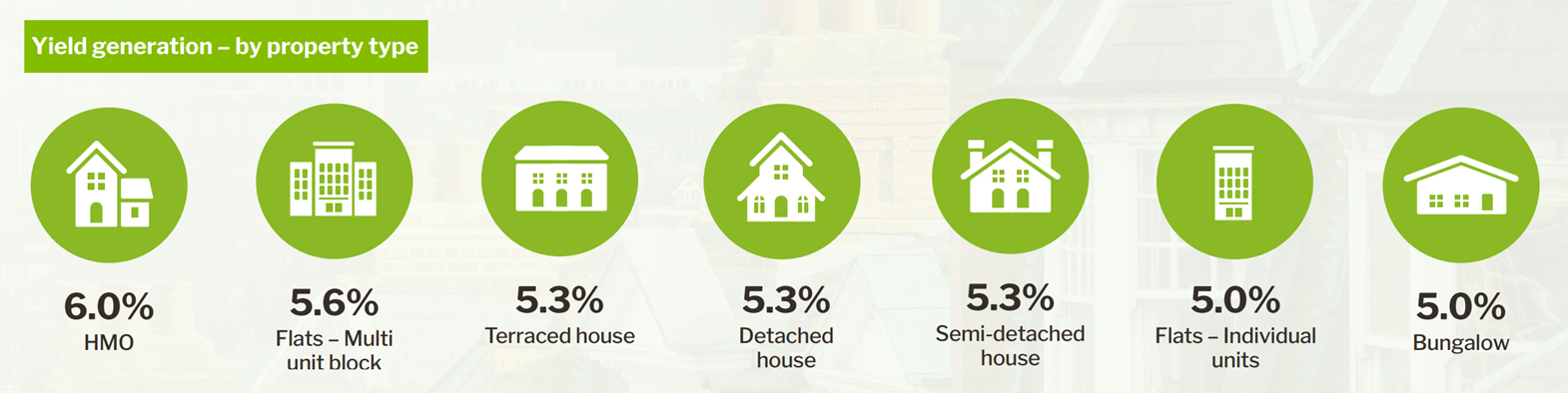

Although the relative cost of ensuring an HMO is legally compliant is higher than it was 15 years ago, rental yields are still strong. Paragon Banking Group’s PRS report for the first quarter of this year in England shows HMOs generate the best yields at 6%, versus 5.3% for houses and 5% for flats and bungalows. And their latest research shows HMO yields around the UK varying from around 6% to 9%.

Source: Paragon Banking Group

What’s just starting to have an effect on the profitability of HMOs is the sharp rise in mortgage rates and of course utility bills. Those landlords who are having to remortgage in the current climate could find their monthly payment tripling, which will hit HMO landlords with high LTV mortgages particularly hard. So if you already have an HMO or you’re thinking of investing, it’s never been more important to run the numbers – before you buy and then regularly once your HMO is let, so you don’t get any surprises.

Where are the current HMO hotspots?

Generally speaking, you should be able to find a good HMO investment in most major towns and cities. But the widespread shortage of student accommodation over the last two years has created great opportunities for student HMO landlords in Manchester, Bristol, Durham and Glasgow in particular.

Looking at the UK regions, Paragon’s research shows that Wales leads the way on returns, with the average HMO delivering a yield of just over 9%, followed by Yorkshire & Humber and the North West at 8.6%. The South East (7.18%) and London (6.13%) deliver the lowest yields, which is to be expected, given the high property values. All these are gross yield figures, so the higher running costs of HMOs have to be taken into account, but if you run the figures for any individual HMO versus a comparable single-let property, you should still see much higher rental returns.

Secure expert, local help when investing or running an HMO

What is essential when investing or running an HMO is to keep in touch with a qualified letting agent that understands the compliance minefield of an HMO and also understands the different target markets, from budget to boutique hotel. You can hear more about HMOs being an untapped market on our podcast, The Property Crowd.

We understand the importance of making sure an HMO deal stacks up financially and meets health and safety criteria for tenants, so do contact us for help and support.

Looking for advice?

If you're looking to let or sell your property, we can help. Get in touch with your local branch or book in for a property valuation.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.