Property sales predictions for 2024

First, a look back on 2023

As with many things, the property market can be a bit of a ‘postcode lottery’, with some areas performing much better than others. One of the key drivers for this since September 2021 is the 14 mortgage rate rises, which have put pressure on affordability. That’s naturally had more of a negative impact on areas where prices are on the high side, due to demand being greater than supply, and many buyers were already stretched financially.

As a result, London, the South East, South West and the East of England have had a tougher year than the rest of the country. The only anomaly is the Midlands, which has also seen transactions suffer. Although the reason for this isn’t absolutely clear, it may be to be down to the fact that towns and cities in this region are often considered ‘hotspots’ for buy-to-let investment – and landlords are one of the key buyer groups that have suffered this year, as all of their costs - from mortgage finance through to renovation costs and utility bills for HMO landlords – have rocketed.

But although transactions for 2023 are expected to have fallen from the ‘average’ 1.2 million sales to 1 million (a fall of around 16.5%) property prices have, in the main, held up much better than predicted.

Most forecasters suggested average prices would fall by 10% this year - with some predicting they would drop even further. However, Zoopla look to be the winning forecasters so far, with their estimate of a 5% fall, as Nationwide has reported property prices being down by 5.3% this September versus the same period in 2022.

By October, Nationwide was reporting lower annual falls of 3.3% and – in a positive turn - month-on-month price growth for the first time this year. Nevertheless, it’s likely that most property price indices will continue to show small year-on-year falls because they will be comparing a slowing market this year to one that was struggling against the impact of the disastrous Liz Truss mini budget that resulted in around 40% of mortgages (mostly fixed rates) being withdrawn.

So, with a quieter property market this year due to the continuing cost-of-living crisis, made worse for buyers and sellers with the rising mortgage rates, what’s in store for 2024?

Predictions for 2024

There has always been a link between economic activity and how well the property market performs. Historically, the better the economy, the more property prices and transactions would rise - and vice versa. However, while there is still a relationship, the level of impact the economy has on the property market appears to have lessened since the pandemic.

Despite one of the worst economic performances in history through the height of Covid, the property market moved 1.5 million people in 2021 and many, especially those with houses, saw property prices rise by double digits. And even in the face of a cost-of-living crisis and 14 base rate rises, we haven’t yet seen any sign of a significant collapse in house prices.

So, the questions for 2024 are really, whether the economic performance will improve and, if it does, whether that will positively impact the property market.

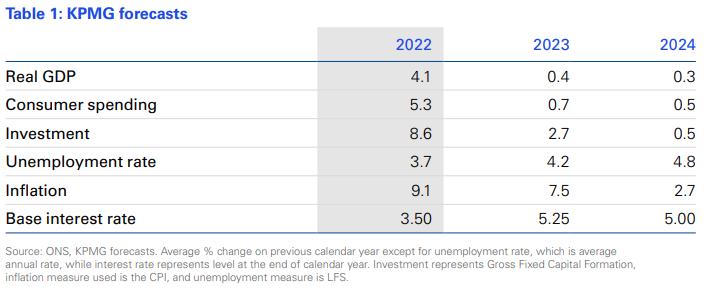

The key to a better economy and property market in 2024 will be what happens to inflation. Kevin Shaw, Group Sales Managing Director at LRG, says, The news that CPI-linked inflation has dropped to 4.6% in October is very good news for the property market and we are already seeing some reductions in mortgage rates, which is excellent news for would-be movers. So far in Q4 at LRG we are seeing supply (based on registration of homes for sale) at a similar level to last year, purchases up 40% and fall-through rates significantly improved on a year ago.

And with the forecasters expecting inflation to fall to around the 2% target by the end of next year, this is likely to boost transactions and at least help ensure property prices hold their value.

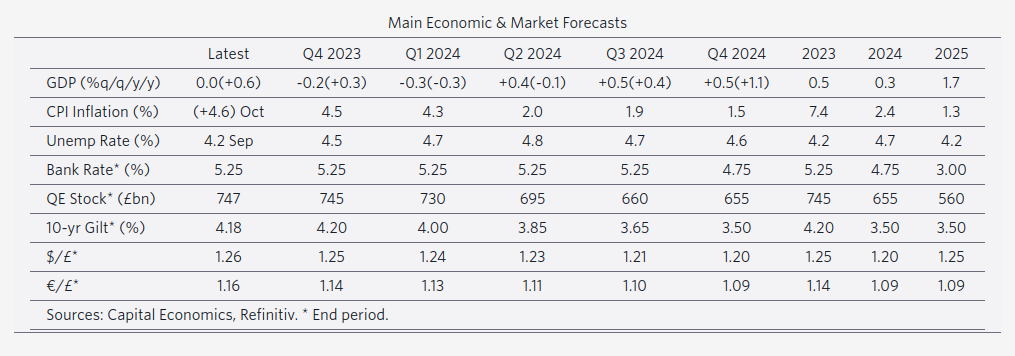

Along with the fall in inflation forecasts, the Bank of England base rate (which drives mortgage rates) is expected to fall from its current 5.25% to below 5% by the end of next year – and to around 3% by Q4 of 2025. That will take the pressure of the high rates we are seeing at the moment, which is good news for both homeowners and would-be buyers.

Sources:

KPMG: Economic Outlook – September 2023

https://assets.kpmg.com/content/dam/kpmg/uk/pdf/2023/09/uk-economic-outlook.pdf

How will a reduction in inflation and the base rate impact the property market?

They expect property prices to re-adjust to around 2% lower than they have been this year, but it’s important to remember that for the many who saw huge price growth during the pandemic, most property values will still be significantly higher than they were back in 2019.

Meanwhile, they are forecasting sales transactions in 2024 to be around 1 million. Although that’s still 200,000 below average, we know from the market we have seen this year that those who are serious about selling and buying will continue to do so.

Importantly, if a property is priced correctly, this can actually be a great market in which to move. When fewer transactions are taking place, there is less pressure to move quickly, and buyers tend to have more choice because there’s less competition for each property. That also means prices are more stable and assured, rather than being forced up, and there’s less risk of getting into 'bidding wars' - all of which means it's a much less stressful process for both buyers and sellers.

So for those that might have held off selling and buying in 2023, it looks like 2024 could be a really good market. However, this very much depends on your property and the street it sits on, coupled with the supply and demand in your local area. Do talk to our experts, who can help you decide whether 2024 is the right year for your next move!

Looking for advice?

If you're looking to let or sell your property, we can help. Get in touch with your local branch or book in for a property valuation.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.