We hear a lot in the news about how much properties cost, how long it would take a first-time buyer to save for a property and the ‘average income’ required to buy a property. Although many people searching for their first home might think renting or buying is pretty impossible, what’s rarely explained and calculated is how much the different ways you can put a roof over your head actually cost – and how they compare. When you look at the reality ‘on the ground’ and move away from the averages quoted, buying and renting can be more affordable than first thought.

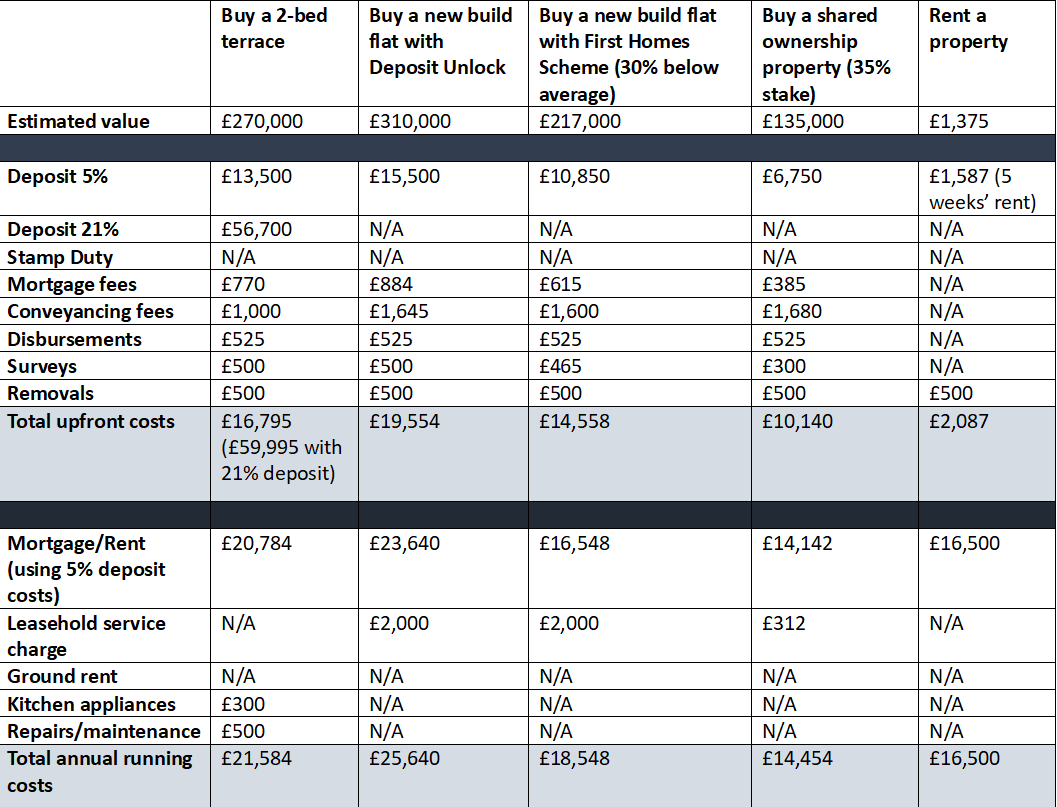

We've calculated the cost of five different ways you could put a roof over your head in Reading. The table below shows how much you would need to save and how much it would cost you to buy and run a two-bedroom property that is:

1. An existing property, such as a Victorian terrace

2. A brand-new property that you can purchase with a 5% deposit with the ‘Deposit Unlock’ Scheme

3. A property that could be purchased via the new ‘First Homes’ Scheme

4. A part buy, part rent property, otherwise known as ‘shared ownership’

5. Rented from a private landlord

The table shows the breakdown of two main costs:

1. The amount you would need to save to get you ‘through the door’, including buying costs such as mortgage and legal fees, or a deposit if renting.

2. The amount it would cost you each year to pay for household expenses, such as mortgage repayments and repair costs, and service charges and ground rent if it’s a flat.

Sources: Halifax FTB Review 2022 and Reallymoving.com/moving-cost-calculator

The Government’s Lifetime ISA can help provide £4,000 a year towards your deposit for a home in Reading

We often hear that you need tens of thousands of pounds deposit, which will take you years to save, but our figures show that this isn’t the case. Many properties can be bought with a 5% deposit – as long as your income can cover the mortgage required.

In addition, if you save for your deposit via the Lifetime ISA, the Government could contribute towards your deposit with their 25% bonus payment on top of your own savings (you can save up to a maximum of £4,000 each year). For example, if you needed to save £20,000 for a deposit, and there were two of you, you would have to save £10,000 each. But if you took out a Lifetime ISA over 4 years, you would only need to save £7,776 each – that’s just £162 a month – and the government bonus, plus interest, would give you a total of a little over £10,000 (according to Beehive’s calculator). Although that is still tough when we’re in a cost-of-living crisis, it’s much more achievable than saving the reported £93,700 deposit required on average by Halifax!

Renting in Reading is cheaper than buying*

The figures clearly show that, in Reading, renting is by far the easiest and cheapest way to put a roof over your head. A two-bed property typically rents for £1,375 a month and the maximum you can be charged for a deposit is five weeks’ worth of rent, so that’s £1,587 you would need to save prior to moving in - on top of your first month’s rent payment.

And if you used a ‘zero deposit’ insurance scheme, such as our own No Deposit Option (NDO), you could greatly reduce your up-front costs as you pay a monthly ‘insurance fee’ instead of a deposit. If there are problems when you leave the property, you will still be charged for any legitimate damage, but you don’t need to set aside the money in advance. And with our NDO scheme, all the rental payments you make will help build up your credit score via Experian.

In terms of annual costs, because you don’t have to worry about any service or ground rent charges and the landlord will take care of property maintenance and repairs, renting is clearly a lot cheaper than buying. Of course, over time buyers benefit from buying their home ‘bit by bit’ via a repayment mortgage and securing additional equity from price increases. Tenants, on the other hand, will only see their monthly rent payments increase over the years, which is a big reason why so many are keen to save for a deposit to buy.

Shared ownership in Reading is the cheapest way to own a property

Shared ownership can be a great way to get on the ladder – it just depends on what options are open to you.

For example, if you can buy a property via the new First Homes Scheme, then this is likely to be better than part buying and part renting a property under shared ownership, especially as you will be able to purchase with freehold as opposed to a leasehold agreement. It won’t cost you huge amounts more in savings, nor in running the property over the year, particularly if there are two of you buying.

However, if you can really only afford to rent on-going, even though you may have to pay a bit extra, shared ownership could allow you to buy the property you need. Perhaps you need two bedrooms and other affordable purchase options would only give you one, or maybe you can’t move somewhere cheaper because your family support you with childcare, so you need to stay in the Reading area. In that case, shared ownership can offer you security and the chance to buy the property over time as your income improves - or indeed sell up and buy on the open market in the future.

Before going ahead, you must make sure you know all the ongoing costs of shared ownership, including service and any ground rent charges, and how much these might increase by - especially the rent part of the scheme. You also need to understand that when you come to sell, you will have to pay for a valuation and it may take longer to find a buyer than with a property you fully own. Our sister company SOWN are available to answer any questions you may have on shared ownership.

It could be more expensive to buy a new two-bedroom flat versus an existing terrace

As a new property will be built to the latest standards and typically has the latest ‘tech’, new builds are often more expensive than existing homes, so it’s no surprise that they come out in our analysis as the most expensive option – unless you can afford to buy with more than a 5% deposit.

However, it is important to work out all the running costs over a 5-year period, rather than our 1-year calculation, as it’s likely that the new property will have an energy performance rating between A and C. This means that your utility bills are likely to be cheaper and you will avoid the need for any major upgrades, such as a new boiler or roof.

According to the new-build trade body, the Home Builders Federation, a new-build property could save the average home owner over £3,000 per year for a house or just under £1,400 for a flat. So, if you’re buying a new-build house in Reading, it’s possible that the ongoing costs could be reduced further - still higher overall than for an existing property, but only by a few thousand pounds a year.

Putting a roof over people’s heads has always been a challenge affordability-wise, but if you're looking into buying or renting in the area of Reading, do get in touch so we can help you understand what will work with your budget – you might be pleasantly surprised!