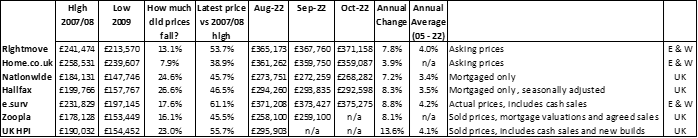

Over the last year, property prices have risen around 8%* which is great news for existing and new homeowners, but what isn’t so good is that the cost of servicing a mortgage has also risen.

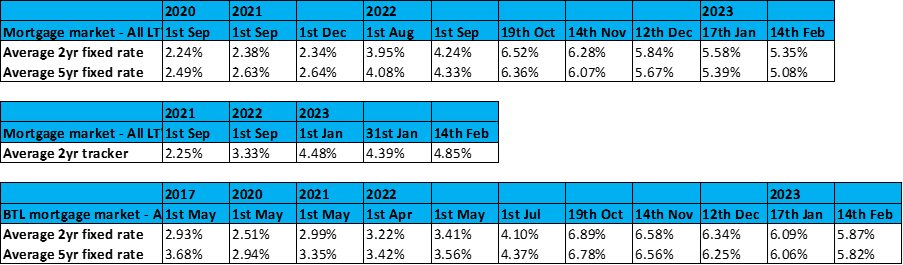

In September 2021, the bank interest rate was just 0.1% and as a result it was possible to secure mortgage rates from 2-4%. A year later, the interest rate rose and by September 2022, mortgage rates ranged from 3% to 5.5%. However, post the disastrous mini budget, some fixed rates rose as high as 6%.**

*Source: Propertychecklists.co.uk

**Source: Moneyfacts

That’s a huge movement in just one year, which for some, has meant their mortgage costs have increased by hundreds, if not thousands of pounds a year, and it’s one of the reasons why we feel it’s incredibly important to review your mortgage on an annual basis.

Changes to interest rates

Over the last 12 months there have been a staggering 8 changes to interest rates:-

(December 2021: Increased from 0.1% to 0.25%)

February 2022: 0.5%

March 2022: 0.75%

May 2022: 1%

June 2022: 1.25%

August 2022: 1.75%

September 2022: 2.25%

November 2022: 3%

December 2022: 3.5%

Source: https://www.money.co.uk/mortgages/bank-of-england-base-rate

For homeowners on tracker, discount or standard variable rates, this means mortgage rates are likely to have increased fairly quickly after the Bank of England announcement.

For those on fixed rates, mortgage payments are likely to have stayed the same. But, even if a home owner is on a fixed rate mortgage now and it doesn’t end until next year or even later, it is still incredibly important to check in with a mortgage broker sooner rather than later to understand how much a mortgage might be after the fixed rate ends. This would allow home owners to prepare and budget ahead of time for paying more - if needed.

Changes to mortgage product

Another reason to check your mortgage options every year is that lenders are constantly reviewing their product range against the economic and individual lending situation they’re operating within - typically making changes to their mortgage offerings at least once a quarter.

This happened quite dramatically just after the mini budget at the end of September 2022. Markets panicked and as a result lenders had to withdraw all their fixed rate mortgage products as they weren’t able to predict the cost in future. This didn’t affect buyers or those remortgaging that had received an offer, but it was an extremely scary time for those waiting for an offer or hoping to buy.

Since this time, although variable rates have remained reasonably competitive, fixed rates jumped to over 6% once they were reintroduced by lenders. However, with the change in Prime Minister and the Chancellor of the Exchequer, Rishi Sunak and Jeremy Hunt managing to calm markets further with their new Autumn Statement, Moneyfacts are now reporting fixed rate mortgage are dropping towards 5%.

Source: https://moneyfacts.co.uk/news/mortgages/average-five-year-fixed-mortgage-rate-drops-below-6/

Further fall in rates?

It’s possible there will be a further fall in fixed rates over the coming 12 months.

So for anyone on a fixed rate mortgage now or looking to buy a property, it’s really worth keeping in touch with a mortgage broker that monitors all mortgage deals so they can help you secure the best one for your circumstances.

In addition, it’s worth knowing that your credit rating can also make a difference to the products available to you. If you didn’t have a great credit rating when you took out your mortgage and that’s now improved, you may be able to switch to a product with a lower interest rate.

An improved loan to value ratio

The loan to value (LTV) is a calculation that shows your mortgage borrowing as a percentage of the value of your home. For example, if your home was worth £250,000 in 2020 and you had a mortgage of £200,000, then your LTV would have been 80%.

While there are a few different reasons why you might get an improved LTV over time, the most likely one for this year versus last is an increase in the value of your property.

Using the example above, say your property price had increased over the past year to £275,000, and you’d spent another £10,000 paying down your mortgage, you would now have an LTV of 69% (£190,000 ÷ £275,000 x 100).

From a lender’s perspective, the lower your LTV, the less risky it is for them to lend to you, so they will often offer better rates.

Why it’s worth contacting a broker to review your mortgage

It is possible to go direct to lenders to find out about their latest products. However, with so many factors influencing whether switching mortgages is the right move - such as the rate, terms and conditions, redemption penalties, length of the mortgage and your own personal and financial objectives for the future - it’s well worth contacting a qualified and regulated mortgage broker who can explain the full implications of switching.

There is the added advantage that a broker will be able to quickly identify which lenders and products may be more suitable for you and your circumstances, saving you hours of research. In some cases, they may also have access to exclusive deals that you wouldn’t be able to find if you went to a lender directly.

Whether you go direct to a lender or use a broker, it’s well worth setting up an annual diary note to review your mortgage finance. Remember, even a small reduction in your interest rate could result in a saving of thousands, if not tens of thousands of pounds over the lifetime of your mortgage.

For mortgage advice you can trust, our partner Mortgage Scout offers appointments that you can book online to discuss re-mortgaging.